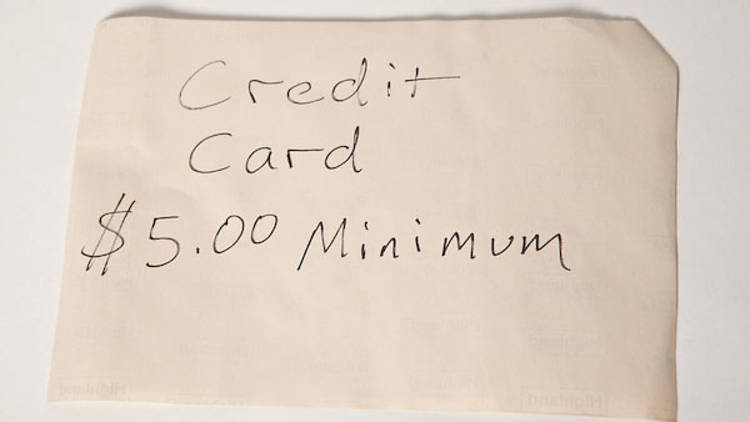

Is it illegal for a business to have a credit/debit-card minimum?—Gabrielle, Logan Square

Credit-card companies used to decide whether merchants could impose a minimum amount on card transactions. Visa and MasterCard prohibited it, American Express frowned upon it, and Discover made agreements with each merchant. Buried in the 848-page Dodd-Frank Wall Street Reform and Consumer Protection Act, which went into effect July 2010, was a clause allowing store owners to enforce a minimum of up to $10 per transaction. Merchants, especially those with thin profit margins, sometimes try to set higher minimums to offset the transaction fees levied on them by the credit-card networks. So if you come across a store with a credit threshold of more than $10, you can blow the whistle by calling the number on the back of your card, says Jessica Tharp, vice president of the Better Business Bureau of Central Illinois. (For example, a bakery in Logan Square requires a $12 minimum purchase; the owner did not return our calls questioning the requirement.) Tharp also urges consumers to report merchants who institute a minimum amount on debit transactions, which the law does not allow.