[category]

[title]

A new KPMG analysis reveals the gap between Boomers and Gen X is narrowing, while younger Australians are quietly getting richer

For years, we’ve been told younger Aussies are falling behind – but new data tells a more nuanced story. KPMG has crunched Australian Bureau of Statistics (ABS) data for the 2024-25 financial year to reveal average household wealth by generation. While Baby Boomers (born 1946-1964) still hold the highest overall net worth, Gen X (1965-1980) leads in property and share market investments. Meanwhile, some younger households are seeing rapid gains, with 25 to 34-year-olds recording the largest five-year increase in household wealth.

Before we dig into the results, it’s important to mention that these figures are per household, not per person – so the numbers may look higher than expected. They’re also averages rather than medians, which means a few high-wealth households can skew the numbers upward.

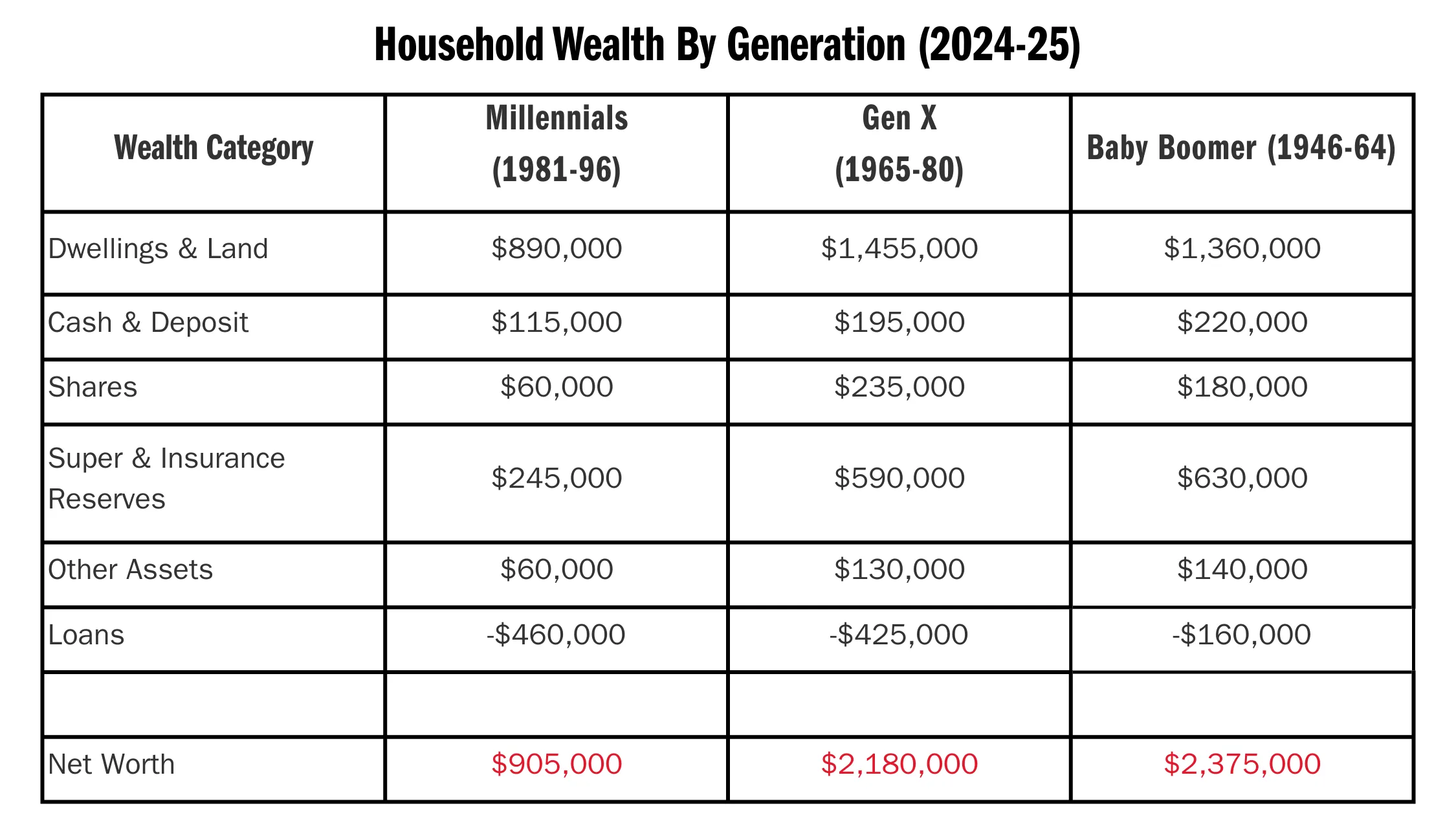

Overall, Baby Boomers (born 1946-1964) had the highest average net worth at $2.375 million, with Gen X (born 1965-1980) close behind at $2.18 million. Both figures are more than double the average net household wealth of Millennials (born 1981-1996), which sits at $905,000.

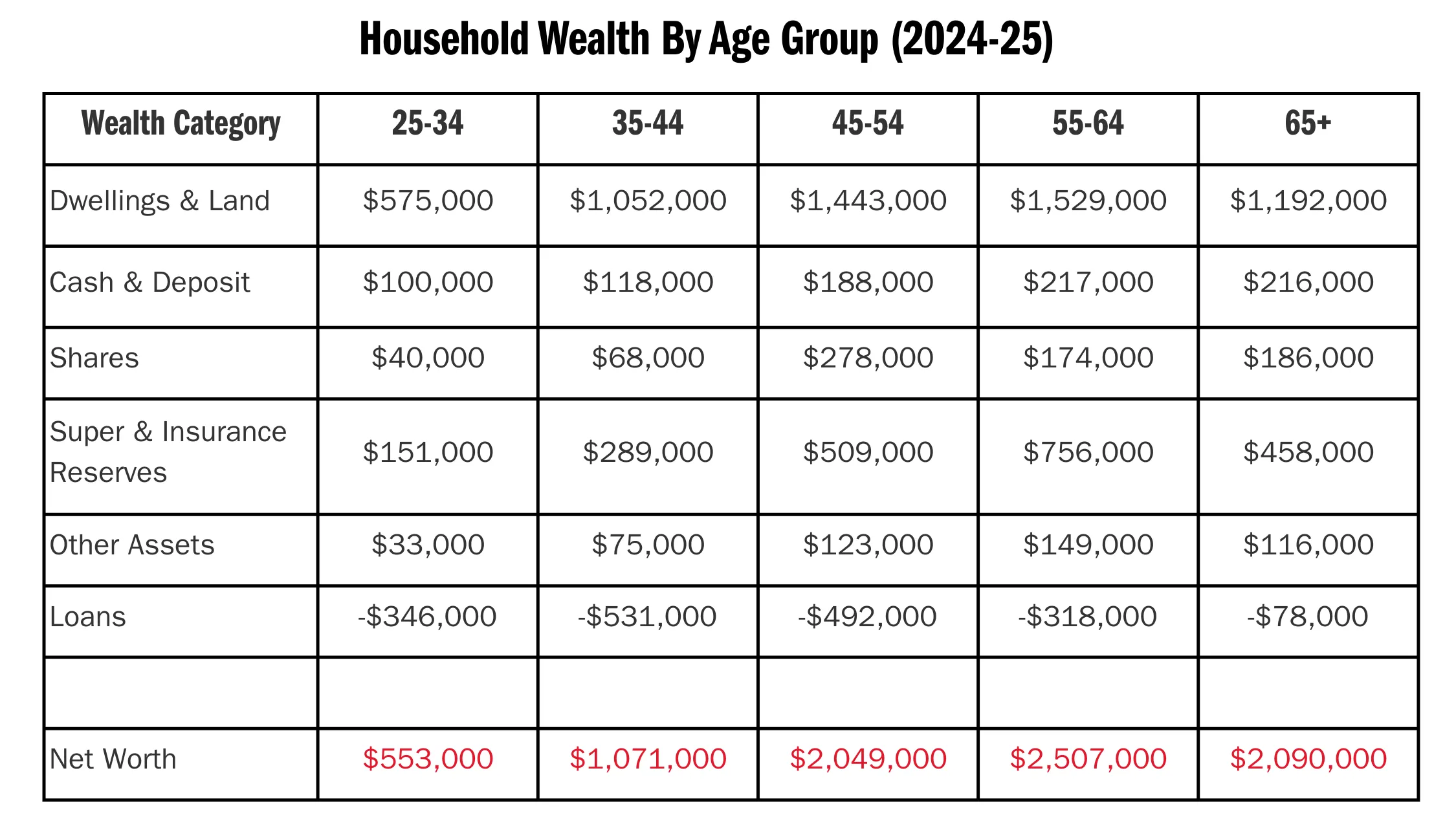

For comparison, the Australian average household net worth was $1.66 million as of June 2025, with housing assets making up almost 70 per cent of that total. Wealth peaks between ages 55 and 64, when the average household net worth climbs to $2.507 million.

The KPMG analysis reveals that as Boomers move into retirement, they’re distributing financial resources from property into safer liquid assets like cash and super, or transferring funds to their children. As a result, Gen X now holds the most property wealth, averaging $1.455 million per household – $95,000 more than Baby Boomers.

While the average household wealth of Baby Boomers and Gen X is almost five times higher than that of the 25 to 34 age group ($553,000), the younger generation has seen surprisingly rapid growth. 25 to 34-year-olds recorded the largest five-year increase in wealth, rising by 63 per cent to an average of $550,000. The researchers attribute this to lucky first-home buyers who purchased property just after the COVID and have since benefited from soaring house prices.

It’s no surprise that 35 to 45-year-olds carry the most debt, with average household loans of $531,000. This is often the stage when many Australians are buying their first homes, juggling hefty mortgages alongside outstanding HECS debts. But there’s a silver lining: younger generations are expected to retire with far higher superannuation balances than today’s retirees. You can compare average household wealth by age group below.

Discover Time Out original video