It was almost enough to make Broadway in Chicago president Lou Raizin burst into an impromptu song-and-dance number.

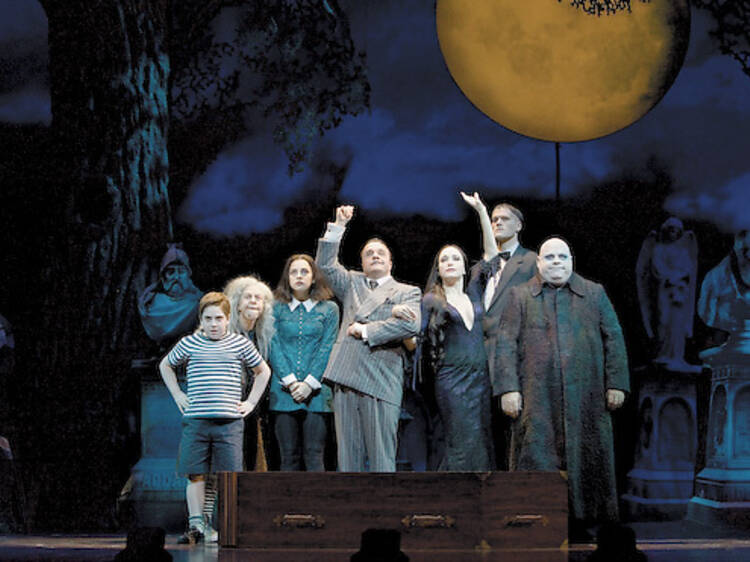

Buried in a tax-break package signed by Gov. Pat Quinn on December 16 that convinced Sears and CME Group to stay in Illinois was a victory for Chicago theater: the creation of the Live Theatre Production Tax Credit. It allows for up to $2 million in incentives to for-profit live-theater presenters that could give Illinois a competitive leg up on other states in attracting and keeping more pre-Broadway and long-run shows such as The Addams Family and Jersey Boys. The legislation also aims to create and retain theater jobs. Presenters can apply for the credit at the end of the tax year with the Department of Commerce and Economic Opportunity, which may award credits worth up to 20 percent of their spending in Illinois.

Inspired in part by the similar Film Production Tax Credit Act that was passed three years ago, Raizin has been actively lobbying Springfield legislators on the tax credit for years. “I’ve walked the halls and testified before a number of committees,” he says. “This bill has meandered through, and it’s been no easy or straight road.”

It was introduced in January as SB 5, sponsored by Sen. Dan Kotowski (D–Park Ridge), but stalled in the Senate in March. By late May, the Senate had tacked on the credit to HB 1355 and approved the bill. But sent back to the House for concurrence, it fizzled. In November, the House and Senate drew up separate but similar tax packages. In the House version, SB 397, the theater tax breaks amounted to only $1 million. The Senate’s version, HB 1883, included the $2 million that would be pinned to the final draft of SB 397 that passed on December 13.

“We in the Senate felt that the $1 million wasn’t enough,” says Sen. Toi Hutchinson (D–Olympia Fields), chair of the Senate Revenue Committee and a sponsor of both bills. “The $2 million is still on the small side, but it’s the best we could do in this negotiating package.” Hutchinson says she pushed for the larger break after witnessing the financial ripple effect of the city’s downtown theater-district productions when she took her daughter to see Wicked during its three-and-a-half-year run at the Oriental Theatre. “When you look at the number of shows that come to Chicago and what people do when they come—stay in hotels, eat at restaurants and shop,” she says, “it’s a significant asset to the city, culturally and economically.”

Raizin agrees. “David Stone, the producer for Wicked, has taken the position that had this legislation been in place during the time that Wicked was in Chicago, the show would’ve played an additional year,” he says. “That would’ve been worth between $600 to $800 million in economic output to the city and state and an estimated 2,000 jobs.”

“The timing was right,” says Rep. David Harris (R–Arlington Heights), the ranking Republican spokesman on the House Revenue and Finance Committee, of slipping the theater credit into the tax package nearly a year after it was created. Besides Raizin, Harris says, “there was a whole range of folks” who testified in person or by letter supporting the credit, including Chicagoland Chamber of Commerce CEO Jerry Roper, the International Alliance of Theatrical Stage Employees Local 2, the Theatrical Wardrobe Union Local 769 and the League of Chicago Theatres.

League director Deb Clapp hopes the break not only creates more jobs for actors, designers and technicians, but also brings a more cutting-edge brand of theater downtown. “Chicago has a lot of nonprofit theaters willing to take the kind of risks that commercial producers are more reluctant to,” she says. “But this tax credit could encourage commercial theatrical producers to take more risks.”

Now that the legislation is in place, Raizin says, the real work begins. “We finally have the tools to help us induce these shows. But it’s not as if the state has written a check and hopes we can perform. We need to perform first before there is any distribution from a tax-credit standpoint.”